Seven Policy Statements Every Plan Should Consider

Seven Policy Statements Every Plan Should Consider

I recently read an article titled “Five Administrative Policies Every 401(k) Plan Needs” by the National Law Review.

I have to say, I’m not sure every plan needs to adopt all five. I think a lot depends on the size of the plan, how much time the plan sponsor allocates to the management of their plan, what kind of process is in place to ensure the plan is being run according to all plan documents, and so many additional factors.

Especially since any policy adopted, becomes an “official plan document” and accordingly, must be followed.

And of course, I always recommend a plan sponsor check with their ERISA attorney before formally adopting any such policy.

7 Plan Policy Statements to Consider…

That being said, here are the policies listed:

- Loan Policy

- QDRO Procedures

- Cybersecurity Policy and Procedures

- Missing Participant and Uncashed Check Procedures

- Investment Policy

Additional policies plans I often see plan sponsors request or use include:

- Education Policy

- QDIA Policy

What are your thoughts?

Do you feel most plans need to adopt all of these policies?

Are there other policies you’ve seen or used with your clients?

Are there other ways to simply document best practices in each area and how the plan is addressing these each year without formally adopting a policy?

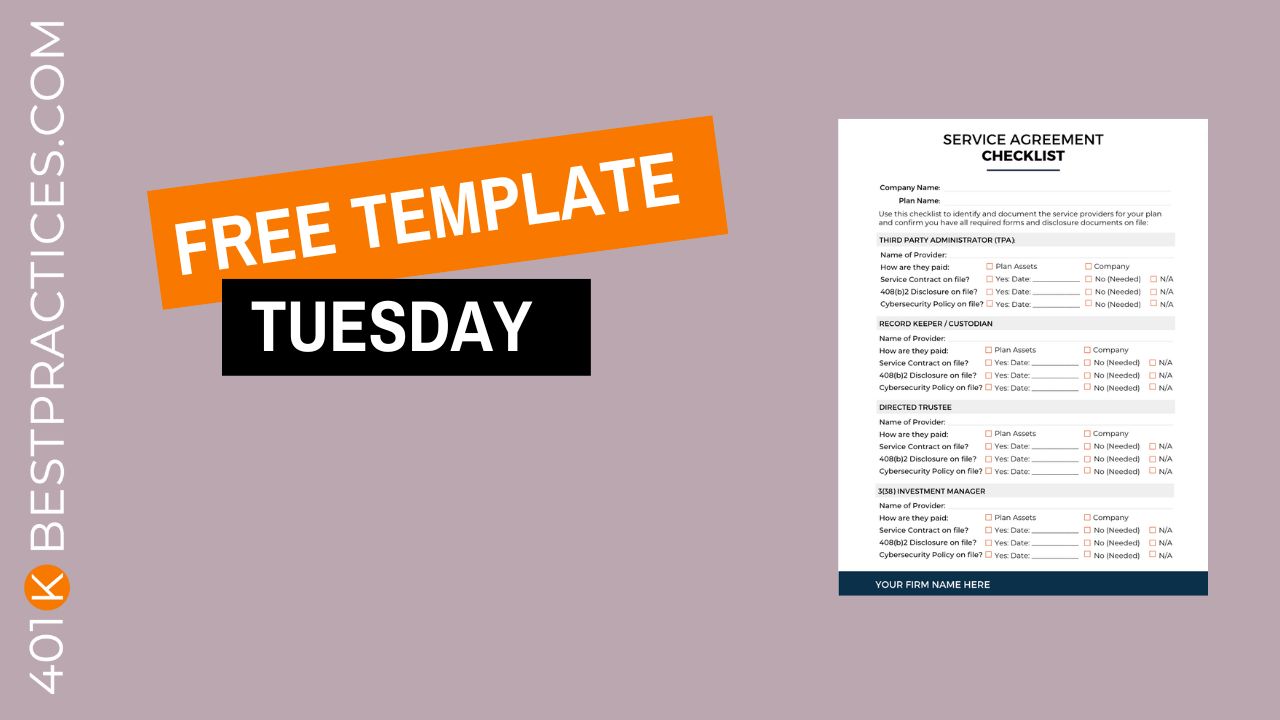

And if you’re looking for a sample best-practice list or sample policy statements for the above topics, check out the new 401k Plan Compliance File Kit.

Fiduciary Risk Management 101 – Building a 401k Plan Compliance File

Fiduciary Risk Management 101 – Building a 401k Plan Compliance File