3 Reasons to Consider Social Media as a Marketing Strategy

3 Reasons to Consider Social Media as a Marketing Strategy

As a 401k Advisor, do you shy away from social media because you’re not sure there are benefits to posting content online?

In this article, we’re talking about why you should be using online or digital marketing in your business. Even if you’re not a social media person.

“I’m Not a Social Media Person”

So this week I had an advisor tell me that after learning about the Social Media Posts in a Box kit, which is available in the 401k Business in a Box set of templates, he revealed that social media is not something he does. “I’m not exactly social media friendly. I rarely utilize it right now,” to quote him – and I’d be willing to bet he’s not alone in that sentiment.

You might not be on social media either, and it’s not uncommon in the 401k industry or financial industry for that matter with the regulations and rules each broker dealer has around what can and can’t be done on social. It definitely makes it challenging.

But today I want to encourage you, if your firm allows it, to consider why it might be a good idea to start using social media.

Now, when I say social media, I’m not necessarily talking about Facebook, Instagram or TikTok. Those platforms are fine, but they’re not necessarily great places for advisors to spend their time – not to say that there aren’t some advisors having a lot of success using those platforms.

But I think I’d recommend platforms that are a little more business oriented, more conversational, more professional, where your business owner audience is more likely to be in the business mindset and not necessarily the entertainment mindset. And that would be Twitter and LinkedIn specifically.

So here are three reasons you might want to consider social media as a marketing tactic for growing your business and building credibility.

1 – Studies Show…

I was reading an article just today titled, “For Financial Advisors, Social Media Needs to be Part of Their Portfolio,” and it referenced a Putnam Social Advisor Survey of 1,021 financial advisors in the U.S.

Some of the key things that I read by going through this, a quote from that article reads, “A study by the financial planning association and LinkedIn pointed out that 40% of investors between ages 18 and 44 find a financial advisor’s online profile important or critical to their decision making process. And 41% of millennials depend on social media for communication with their advisor.”

It’s important to talk to them on each social media platform in the way that makes the most sense.

Another article I was reading titled, “Expert Tells MDRT (million dollar round table) Audience to Gear up for Next Generation of Social Media Selling,” and it talks about how this pandemic has spurred an increased use of social media.

And to quote, “What it means is that your clients, their children, the next generation of your clients are being conditioned to buy through social media networks themselves. They’re getting used to making purchasing decisions through social media.”

And another headline in that article reads, “People want to buy from experts.” and goes on to say, “Everyone wants to buy from experts. They feel that they have a relationship, whether they actually interact with them online or not.” She said, “I guarantee you, there are people that are watching what your organization or you post online (sic), just waiting to interact.“

Social media is a way to help people get to know you.

So that’s my first argument. Studies show that people are looking at, and put credence to, what you have posted on your online profiles. And that’s not just your blog. It is the social media profiles, any place that you have a profile set up, they’re going to expect to see posts, content value, have some way to get to know a little bit about you and if you’re an expert or not.

So having an online profile set up is important and having information posted on is it is even more important.

2 – Prospects Will Check You Out Online Before Hiring You

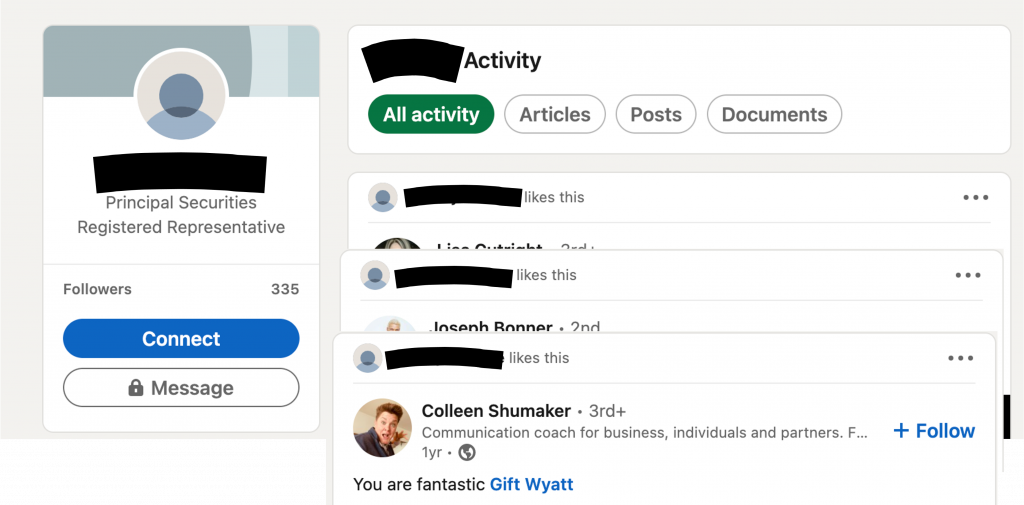

Okay – number two… even if you’re “not on social,” it’s a given that before you’re ever hired as an advisor for a 401k plan, they’re going to look you up online. So my question to you is, “What will your online profile say about you?”

Are you keeping current with industry trends?

Are you providing value online?

Do you have a profile with activity that shows you’re an expert in educator, or is it a ghost town with only the bare bones, ‘registered investment advisor’ description and the only activity you show is liking posts that show up in your newsfeed. It doesn’t necessarily look or sound very professional.

3 – It’s Not That Difficult

Now my third argument for why you might want to consider using social media as a marketing tactic is – it’s not that difficult to set up and create an online presence and just post a couple of times a week and start building credibility. You don’t have to be active daily. In fact, I’d encourage you not to. And I don’t actually recommend that you spend very much time, but your online presence should have content that helps people get to know like, and trust you.

I’ll talk more about what you should be sharing and how often in upcoming articles, and if you listened to the most recent podcast about themes, then you already have the framework of how to map out what to post.

And if you just post once a week on LinkedIn talking about the theme you chose for that month… maybe it’s a re-share of another article (you didn’t even have to write it), or maybe it’s a short video, or a definition with an explanation. It could be a full-on blog post, but something related to that theme just once a week, it’s a great start and better than nothing.

So there are my three reasons. I think you should consider using social media as a marketing tactic. 1) Statistically speaking, it will help you, 2) having content on your profiles that you publish will increase your credibility, and 3) it doesn’t have to be complicated or cumbersome.

Want a Done-For-You 401k Social Media Library?

If you want an easy way to get started on social, I’ve made it super simple with the Social Media Posts in a Box complete kit. There is an entire year’s worth of done for you graphics and post ideas – so you don’t even have to think about what to post. You just take the graphic, copy and paste the text that goes with it, and post it.

You’ll also find over 20 blog post articles inside the vault if you choose to become a 401k Quarterback (which basically gives you access to the full library of templates that get created weekly and added to the template library). Sound interesting? You can learn more at: https://www.401kbusinessinabox.com.

Listen to the Podcast episode of this topic here.

Or watch the video on YouTube here (coming soon).